As Saudi Arabia progresses toward its Vision 2030 goals, the integration of autonomous FMCG delivery vehicles has the potential to transform logistics, offering efficiency gains and cost reductions. The Transport General Authority (TGA) has been instrumental in developing strategies and frameworks to support the adoption of autonomous vehicles across various sectors, including the Fast-Moving Consumer Goods (FMCG) industry. With TGA’s strategic role and Saudi Arabia’s broader National Transport and Logistics Strategy (NTLS), the Kingdom aims to position itself as a leader in autonomous logistics by 2030.

Efficiency Gains Through Autonomous FMCG Delivery Vehicles

Efficiency is at the core of FMCG delivery systems, particularly given the time-sensitive nature of perishable goods. Autonomous FMCG delivery vehicles offer the ability to operate continuously, 24/7, without the need for human breaks, leading to faster delivery times and an increase in overall delivery capacity. This is particularly critical in Saudi Arabia’s expanding urban areas, where traffic congestion can hinder delivery times. With Saudi Arabia’s NTLS targeting 25% of goods transport vehicles to be autonomous by 2030, the potential for optimizing delivery routes and minimizing human errors is substantial.

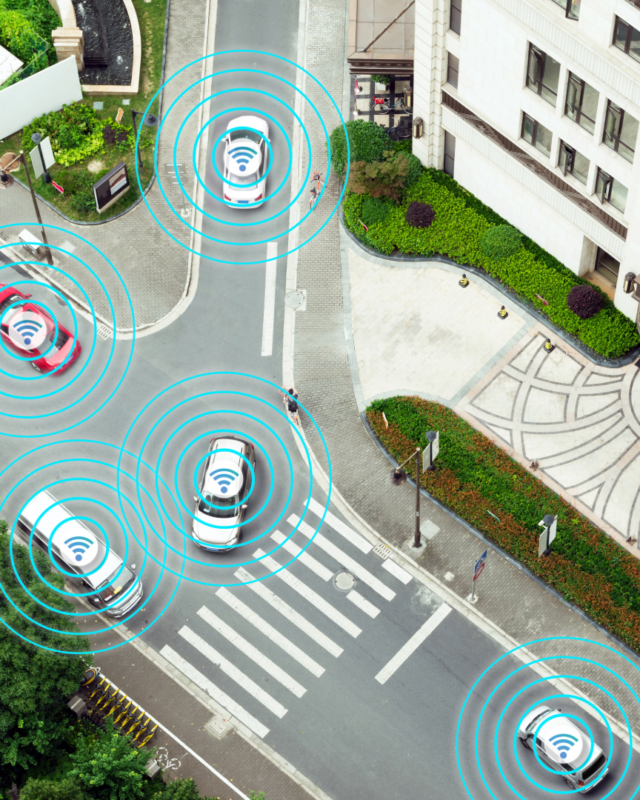

The integration of advanced AI systems in autonomous vehicles allows for real-time route optimization. These systems can process vast amounts of data from sensors, radars, and traffic management networks, enabling vehicles to avoid traffic jams, accidents, or poor road conditions. In cities like Riyadh and Jeddah, where the pace of urbanization is accelerating, this ability to navigate efficiently can save both time and resources, boosting the overall performance of FMCG supply chains.

Additionally, autonomous FMCG delivery vehicles contribute to reducing human error, which is responsible for a significant proportion of logistics inefficiencies. Consistent, predictable, and optimized driving patterns also lower fuel consumption, which translates into substantial operational savings for FMCG businesses.

Cost Reduction Benefits

The financial impact of adopting autonomous FMCG delivery vehicles is notable, particularly in labor and fuel costs. A key benefit is the reduction in labor expenses, as human drivers would no longer be needed. Autonomous vehicles also have the potential to significantly decrease delivery times, allowing companies to achieve more deliveries with fewer vehicles, maximizing fleet utilization.

In the United States, it is estimated that autonomous vehicle technology could save more than $750 billion annually by reducing vehicle crashes and optimizing travel times. While similar statistics for Saudi Arabia are yet to be fully developed, the economic potential is evident. The NTLS aims to turn Saudi Arabia into a global logistics hub, and autonomous FMCG delivery vehicles play a crucial role in achieving this ambition.

Furthermore, fuel efficiency is a major cost-saving factor. AI-powered autonomous vehicles can optimize their driving behaviors to reduce unnecessary fuel consumption. This capability is particularly relevant in Saudi Arabia, where long-distance deliveries across vast desert landscapes are common. Lower fuel consumption not only saves costs but also supports the Kingdom’s sustainability objectives by reducing emissions.

Challenges to Consider

Despite the potential of autonomous FMCG delivery vehicles, challenges remain. The Saudi market is still in the early stages of adopting autonomous vehicle technology, and there are significant hurdles related to infrastructure and regulatory frameworks. As the country works toward implementing its Vision 2030 goals, it is developing new regulations and safety protocols to govern the use of autonomous vehicles on public roads. Saudi Arabia’s Ministry of Transport and Logistics has launched trial phases, such as the ‘Dhahaina’ self-driving electric vehicle project, which is crucial for building public trust and ensuring safety standards.

Another challenge is the technological limitations that autonomous vehicles currently face. For example, sensor performance in extreme weather conditions, such as sandstorms, remains a concern. Autonomous vehicles rely heavily on radar, lidar, and cameras, all of which can be disrupted by low visibility conditions. Ensuring reliable performance under these circumstances will be vital for the full-scale deployment of autonomous FMCG delivery vehicles.

Future Outlook

Despite these challenges, the future of autonomous FMCG delivery vehicles in Saudi Arabia is promising. Mega projects like NEOM and Red Sea Global have already integrated autonomous vehicle technology into their transportation plans, incorporating autonomous pods and airtaxis. These developments highlight Saudi Arabia’s commitment to creating smart cities powered by cutting-edge technology.

As Saudi Arabia continues to invest in autonomous technology and develop regulatory frameworks, the adoption of autonomous FMCG delivery vehicles is set to accelerate. By improving delivery efficiency and reducing costs, autonomous vehicles will play a key role in transforming the FMCG sector, positioning the Kingdom as a global leader in logistics innovation.