Saudi Arabia is taking bold steps to become a global player in energy transition, and lithium is now at the heart of that vision. As demand for electric vehicles (EVs) and renewable energy surges, the Kingdom is building a Saudi lithium energy hub to fuel the future.

Twenty-Fold Demand Surge by 2030

By 2030, Saudi Arabia expects lithium demand to increase twenty-fold. This growth will support the production of 500,000 EV batteries and the deployment of 110 gigawatts of renewable energy capacity. These goals are part of a broader strategy to reduce oil dependence and boost clean energy investments.

To meet this demand, Aramco, in partnership with Ma’aden, is moving aggressively into lithium production. Their joint venture targets commercial-scale output by 2027, starting with pilot operations in 2025.

Saudi Lithium Energy Hub: Technology at the Core of Extraction

The venture isn’t relying on traditional methods. Instead, it uses direct lithium extraction (DLE), a breakthrough developed at KAUST (King Abdullah University of Science and Technology). This technology pulls lithium from brine in oil fields, increasing yield and reducing environmental impact.

Aramco has identified brine sources with lithium concentrations of up to 400 parts per million, unlocking previously untapped reserves and cutting down production costs.

Read Also: Tesla to Enter Saudi Arabia: Saudi’s EV Expansion in 2025

Why Saudi Arabia is Building a Lithium Energy Hub

This lithium push is part of Vision 2030, Saudi Arabia’s long-term plan to diversify its economy. The Kingdom aims to unlock $2.5 trillion in mineral wealth, with mining’s GDP contribution set to grow from $17 billion to $64 billion.

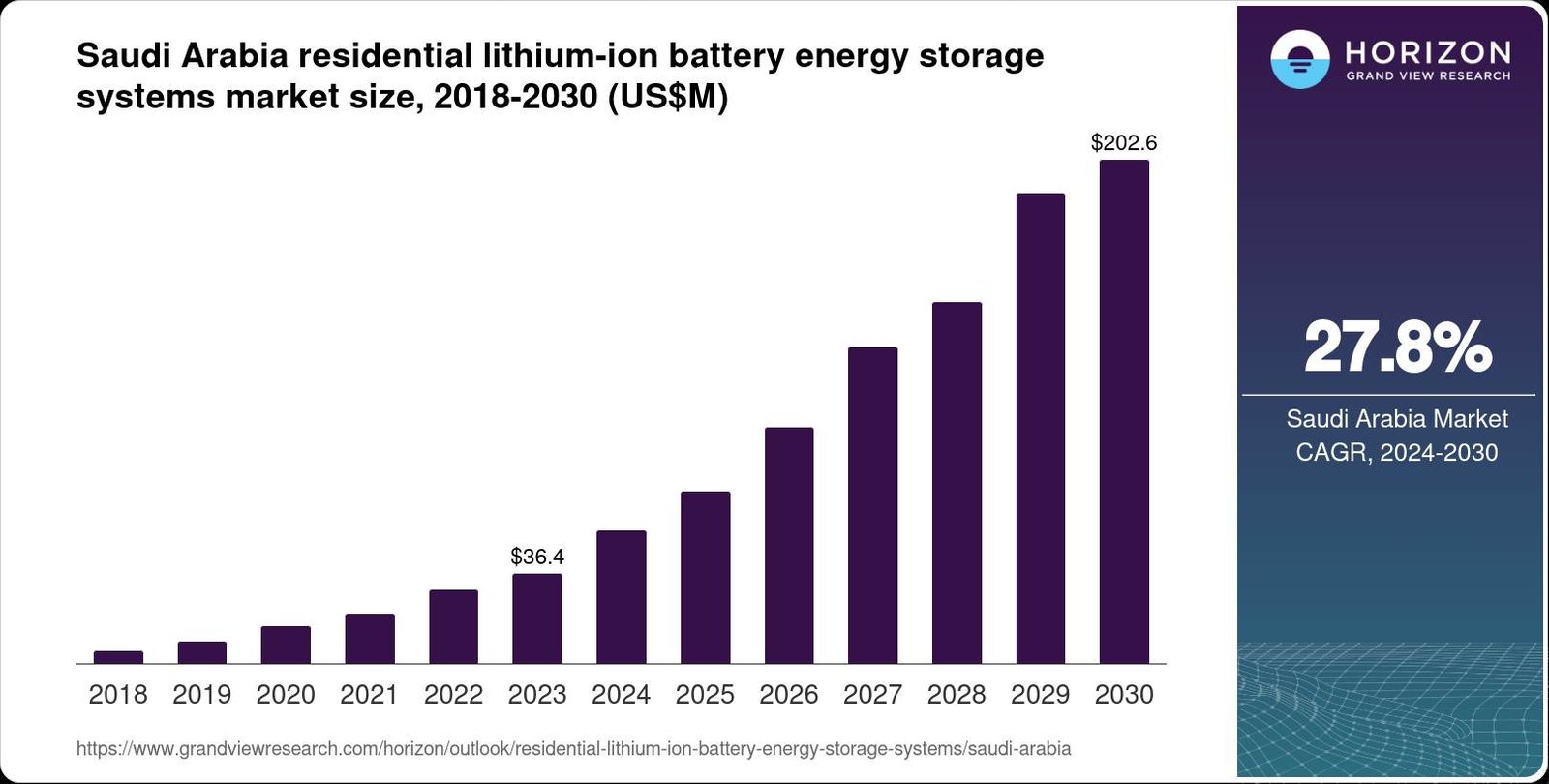

Lithium plays a crucial role in this transformation. The rechargeable battery market is expected to nearly double, growing from $1.16 billion in 2024 to $2.04 billion by 2033, at a CAGR of 6.5%. As EVs and energy storage needs rise, so does the strategic value of locally sourced lithium.

Building Local Battery Supply Chains

Saudi Arabia isn’t stopping at extraction. Plans are underway for a $1.2 billion lithium-ion battery plant with a capacity of 3 GWh per year. This facility will serve local demand and support regional giga projects, including NEOM and the Red Sea development.

By building a full supply chain—from raw material to battery—Saudi Arabia is reducing import dependence and positioning itself as a stable supplier in a volatile global market.

Tapping into Global Trends

Global lithium demand has tripled in the last five years and is projected to grow at over 15% annually through 2035. Saudi Arabia’s investments directly respond to this surge, ensuring a strategic foothold in a critical global resource.

While countries around the world race to secure lithium for EVs and clean tech, the Saudi lithium energy hub combines geological abundance, cutting-edge technology, and state-driven ambition.

Read Also: From EVs to AI: The Digital Transformation of Saudi Transport

Saudi Lithium Energy Hub: A Strategic Charge Toward 2027

With production targeted for 2027, Aramco and Ma’aden are laying the foundation for a Saudi lithium energy hub that will power both domestic innovation and global sustainability goals. By aligning its natural resources with smart policy and green demand, Saudi Arabia is not just keeping pace with the energy transition—it’s aiming to lead it.