Saudi Autonomous Mobility Hits Milestone: $6.07B Market by 2033

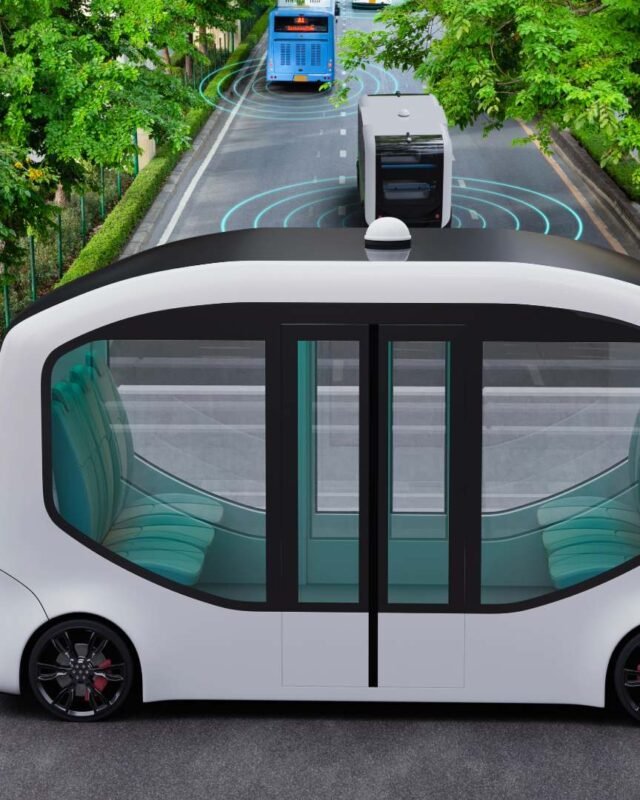

Saudi Arabia’s autonomous vehicle (AV) market is accelerating toward a projected value of US$6.07 billion by 2033, up from US$1.01 billion in 2024. This 22.03% compound annual growth rate (CAGR) reflects a strategic national pivot toward smart mobility, with autonomous public vehicles playing a central role in reshaping transport infrastructure.

Robotaxis Roll Out: Riyadh’s First AV Pilot Targets High-Demand Routes

In July 2025, Riyadh launched its first Robotaxi pilot, a collaboration between WeRide, Uber, and AiDriver. The trial covers high-traffic corridors between King Khalid International Airport and central Riyadh, marking a pivotal moment in Saudi Autonomous Mobility. The initiative received the Kingdom’s first autonomous driving permit and is part of the Initial Operational Phase of Autonomous Vehicles under the National Transport and Logistics Strategy.

With over 104 million public transport users and 349 million intercity bus passengers annually, the demand for scalable, AI-powered mobility solutions is surging. Ride-hailing trips rose 26% and delivery app orders climbed 27% from 2023 to 2024, exceeding 290 million transactions.

25% of Goods Vehicles to Go Autonomous by 2030

Saudi Arabia’s Transport General Authority has set a bold target: 25% of all goods transport vehicles will be fully autonomous by 2030. This aligns with Vision 2030’s broader goals of reducing traffic congestion, enhancing safety, and embedding smart infrastructure across the Kingdom.

WeRide’s Robobuses and Robotaxis are designed to meet these needs, offering scalable solutions for both passenger and freight mobility. The company was the first to complete the Transport General Authority’s Regulatory Sandbox, a framework designed to vet and validate autonomous technologies in real-world conditions.

Delivery Robots Debut: Level 4 Autonomy in Riyadh’s Business Hub

Saudi Autonomous Mobility isn’t limited to passenger transport. In Riyadh’s ROSHN Front Business Area, Jahez and ROSHN Group have deployed five fully autonomous Level 4 delivery robots. Equipped with over 20 sensors, six cameras, GPS, and climate-specific cooling systems, these robots operate during working hours to fulfill last-mile logistics.

Mohammed Al-Barrak, CTO of Jahez, emphasized that automation is a strategic pillar for the company. “We chose to optimize logistics through autonomous delivery. This is just the beginning of many technologies that will transform gated communities and urban logistics,” he said.

Smart Roads and Regulatory Codes Enable AV Expansion

To support Saudi Autonomous Mobility, the Roads General Authority has issued a Self-Driving Vehicles code. This mandates smart road communication devices that relay real-time traffic and environmental data directly to autonomous systems. These regulatory frameworks are critical for ensuring safety, interoperability, and scalability across AV platforms.

Partnerships with key government entities, including the Ministry of Interior, Ministry of Communications and Information Technology, and the Saudi Data and Artificial Intelligence Authority; have laid the groundwork for a robust AV ecosystem. These collaborations ensure that Saudi Arabia’s AV rollout is not just a tech deployment, but a holistic transformation of the transport sector.

AVs Fuel Tourism and Economic Diversification

Saudi Arabia’s tourism sector is projected to reach $110.1 billion by 2033, growing at a CAGR of 8.4% from 2024. Autonomous public vehicles are expected to play a key role in accommodating this influx, offering smart, sustainable transport options for residents and visitors alike.

As the Middle East’s largest economy, Saudi Arabia is leveraging Saudi Autonomous Mobility to diversify into high-growth sectors. The AV market’s expansion is not just about vehicles—it’s about creating jobs in fleet management, maintenance, and customer service, while solving urban mobility challenges.

Also Read: Saudi AAV Mobility: From MoU to market at real-world speed