2025 Saudi Smart Mobility Strategy Advisory Insights: $1B Air Taxis & EV Push

We are witnessing Saudi Arabia enter a pivotal phase in reshaping transportation through electric vehicles (EVs) and urban air mobility (UAM). In 2025, the Kingdom advanced a series of smart mobility initiatives that reveal a bold intent to lead the MENA region in sustainable transport innovation—despite current market hurdles.

June 2025: Saudi Eyes $1B Agreement Toward Electric Air Travel with Joby Aviation

Announced in June 2025, Abdul Latif Jameel and Joby Aviation signed an MoU to explore the delivery of up to 200 electric aircraft in Saudi Arabia, with a total estimated value of $1 billion. This milestone reflects strategic alignment with the Saudi Smart Mobility Strategy, aiming to establish foundational air taxi services in major cities.

Designed to travel up to 200 mph, Joby’s four-passenger aircraft will support the future of zero-emission flight, initially targeting service launches in Dubai by 2026, with Saudi Arabia set to follow. The agreement also covers plans for pilot training, MRO, and aftermarket support—integral components for local capability development.

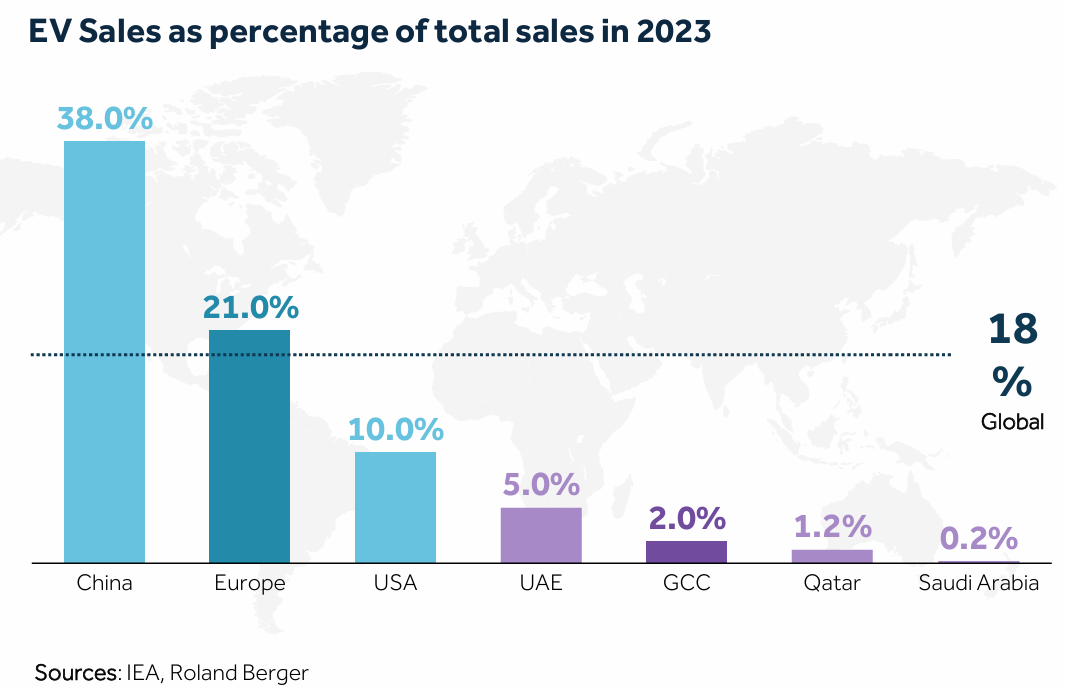

EV Adoption Rates Remain Low: GCC Sales Data Reveal Market Pressure

EV penetration in Saudi Arabia remains modest compared to regional peers. In 2023, EVs made up just 0.2% of total car sales in Saudi Arabia, compared to the UAE’s 5%, and a GCC-wide average of 1.2%. Limited charging infrastructure and low fuel prices continue to deter consumer uptake.

Our advisory recognizes these constraints and encourages multi-pronged solutions—such as expanding fleet electrification, incentivizing adoption through rebates, and increasing gas price parity. Saudi Arabia’s goal to reach 30% EV penetration in Riyadh by 2030 is ambitious, but achievable with scalable investment and policy coordination.

Vertiport Expansion: 22 Saudi Airports to Host UAM Services

In November 2024, UrbanV and Cluster2 Airports launched a partnership to develop UAM infrastructure across 22 airports in the Kingdom. These vertiports will support eVTOL operations for VIP transport, cargo logistics, and medical emergencies, aligned with regulatory and sustainability goals.

As a strategic voice in this evolution, we at the Saudi Smart Mobility Strategy Advisory see vertiport integration as pivotal for linking air mobility routes across Asia, Europe, and Africa—strengthening Saudi Arabia’s role as a logistics and travel hub.

Also Read: 3 Key Areas: Consulting’s Role in Saudi Transport Strategy

NEOM and Lilium: 100 eVTOLs Ordered for Futuristic Urban Mobility

Early 2025 brought another landmark announcement: NEOM signed an MoU with Germany’s Lilium to purchase 100 eVTOL aircraft, marking the first major air mobility airline commitment in MEA. These vehicles are core to NEOM’s next-gen transport ecosystem, offering point-to-point connectivity across vertical cities and sustainable corridors.

Drones in Hajj Logistics: Terra Drone Arabia Cuts Delivery Times by 93%

During the Hajj season in June 2025, Terra Drone Arabia, in collaboration with NUPCO and the Ministry of Health, deployed drones that reduced critical medical delivery times in Mina and Arafat from 90 minutes to under 6 minutes. With DJI Matrice350 RTK drones operating via Unifly’s UTM system, this pilot program showed how autonomous delivery can ease congestion and save lives in complex urban environments.

Our advisory sees such integration of drone tech in emergency services as an exemplar for scalable infrastructure in other high-density or high-risk settings across the Gulf.

Strategic Manufacturing: CEER and Hyundai Advance Localization Amid Market Shifts

Saudi Arabia’s push toward EV industrialization continues with CEER’s partnership with Hyundai Transys, a $2.18B investment aimed at strengthening local EV system integration. While CEER currently operates more as an assembler—relying on components from Hyundai and Nvidia-powered ADAS—it signals intent to evolve into a full-scale manufacturer.

The brand’s joint venture origins with Foxconn and initial vehicle architecture reflect an accelerated entry strategy. However, realizing long-term sustainability will likely require deeper vertical integration and indigenous tech development, especially amid shifting global EV supply chains and increasing competition from Chinese automakers.

Urban Air Mobility Growth: Joby, Eve & Mukamalah Signal a Cross-Market Expansion

Joby Aviation signed another MoU with Mukamalah, a Saudi Aramco subsidiary, to deploy electric aircraft into its corporate fleet—the world’s largest of its kind. Separately, Eve Air Mobility is working with Flynas and Saudia Technic to launch eVTOL operations in Riyadh and Jeddah by 2026, while evaluating MRO frameworks and local assembly requirements.

From a Saudi Smart Mobility Strategy Advisory perspective, we believe that these cross-sector engagements will usher in a new class of high-efficiency transit options, deeply embedded in city planning and national aviation frameworks.

Also Read: 77.8% of Saudis Ready for Smart Mobility: What’s Next?